pa educational improvement tax credit election form

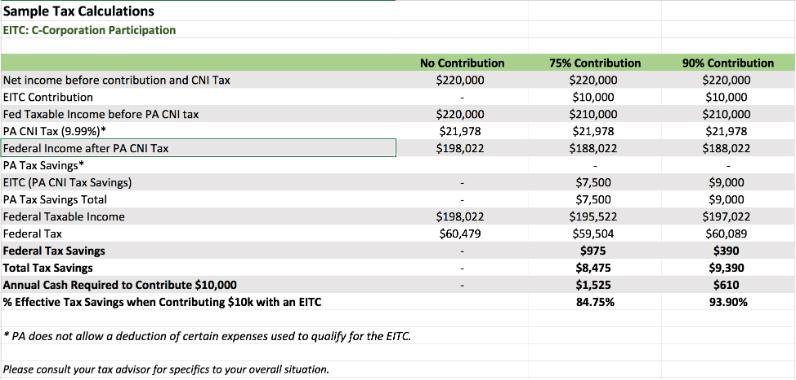

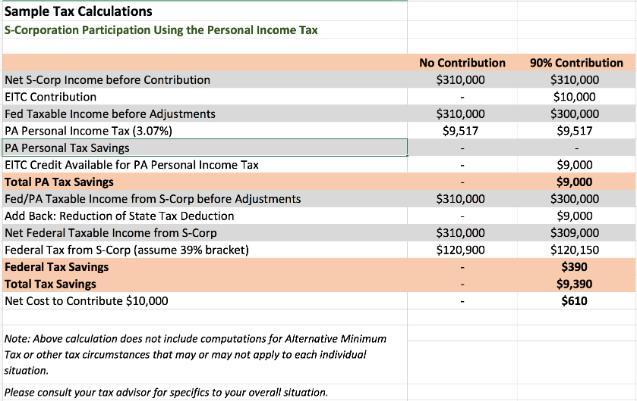

Election to apply unused EITCOSTC to the tax liability of the owners in the taxable year immediately follow-ing the year in which the contribution is made. Invest in Philadelphia children while lowering your state and federal tax liability through the PA Opportunity Scholarship Tax Credit OSTC and the PA Educational Improvement Tax Credit EITC.

Educational Improvement Tax Credit Eitc Program Bucks County Community College

Department Use Only Address.

. Employer Annual W2-R Form. BUREAU OF CORPORATION TAXES. Contributions provide financial aid to families of current students.

The entity has four partners A B C and D. Tom Wolf said Wednesday that he will veto a proposed expansion of Pennsylvanias Educational Improvement Tax Credit which directs millions of potential tax dollars each year to private schools and educational programs. Download File Educational Improvement Tax Credit Program EITC Guidelines.

Department use Only Address. Telephone Number Email Address Identification Number Revenue ID FEIN SSN YYYY 1 Total EITCOSTC awarded in tax year available for pass through Contribution Date Amount MMDDYYYY TOTAL 2 Amount of EITCOSTC to be applied to the. PO BOX 280701 HARRISBURG PA 17128-0701.

PA DEPArTMENT OF rEVENuE BurEAu OF COrPOrATION TAxES - EITCOSTC uNIT PO BOx 280701. Eligibility for the scholarships is limited to students from low- and middle-income families. About 68 percent of Pennsylvania students.

But that doesnt mean that the proposal from House Speaker Mike Turzai R-Allegheny is going to disappear anytime soon. Examples For each example below a calendar year business entity XYZ LLC is awarded 25000 in Educational Improvement Tax Credits in 2020. The Educational Improvement Tax Credit Program EITC provides a way for the businesses and individuals to be involved with education by directing their tax liability dollars to a school of their choice.

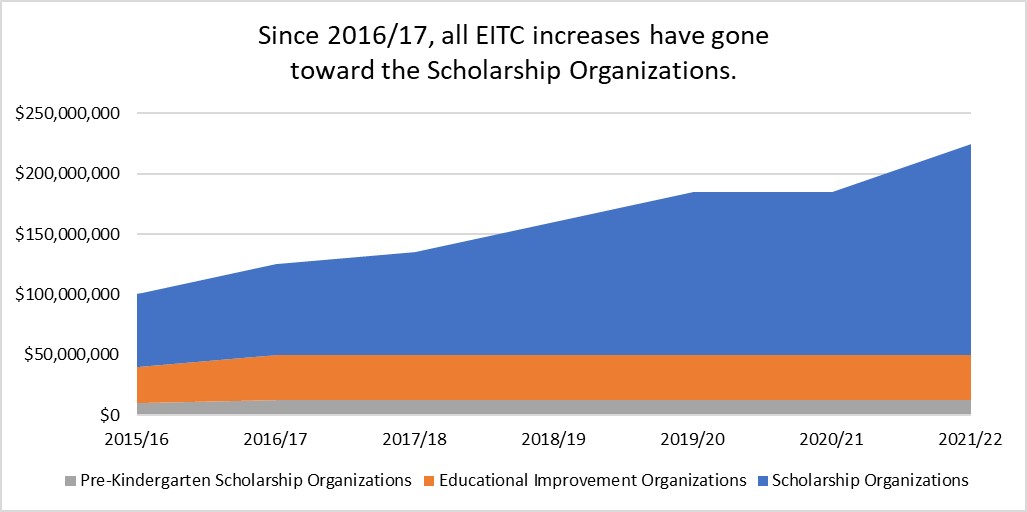

Tax credits to eligible businesses contributing to a Scholarship Organization an Educational Improvement Organization andor a Pre-Kindergarten Scholarship Organization. To pass through a Keystone Innovation Zone tax credit visit the Department of Community and Economic Developments DCED website at dcedpagov or call DCED Customer Service at. Get And Sign Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications 2015-2021.

Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1123 Pass-Through Entity Name. Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business Financing Tax Credit Division 4th Floor Commonwealth Keystone Building 400 North Street Harrisburg PA 17120. DO NOT USE DASHES - OR SLASHES IN ANY FIELD.

URG PA 17128-0604 EDUCATIONAL IMPROVEMENT OPPORTUNITY SCHOLARSHIP TAX CREDIT ELECTION FORM Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners. Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds. Use the REV-1123 Educational ImprovementOpportunity.

Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1123 FILL IN FORM USING ALL CAPS. Certified Tax Officers. A complete form OC is also required.

Contact our Development Office to learn how you can participate. Individual donors must file a Pa 40 individual or joint tax return for the year and include the 90 payment tax credit on page 2 line 23 other credits. Do not use the Single Application.

Identification Number Revenue ID FEIN SSN. HARRISBURG PA 17128-0701 EDUCATIONAL IMPROVEMENT TAX CREDIT ELECTION FORM See Page 3 for instructions. BUReAU oF CoRPoRAtIoN tAXeS PO BOx 280701 hARRISBuRg PA 17128-0701.

Irrevocable election to pass Educational Improvement Tax Credit EITC through to shareholders members or partnersA separate election must be submitted for each year an EITC is awarded and not used in whole or in part by the contributing entity. Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds. A Pa SPE K-1 will be provided by mail in February so the donor has proof of their eitc tax credit.

Of Educational Improvement Tax Credit EITC or Opportunity Scholarship Tax Credit OSTC awarded to a pass-through entity or special purpose entity along with the amounts of the EITC or OSTC to be passed through to the partners members or shareholders owners of the pass-through or special purpose entity. EITC OSTC Frequently Asked Questions Learn more about the top asked questions for the Educational Improvement and Opportunity Scholarship Tax Credit. May 16 Business applicants who have fulfilled their 2-year commitment and wish to reapply in FY 2223 to renew their 2-year commitment.

Educational ImprovementOpportunity Scholarship Tax Credit. The Educational Tax Credits program contains two sections of which credits may be awarded for applicants within the program. To pass through an Educational Improvement or Opportunity Scholarship Tax Credit complete and submit form REV-1123 Educational ImprovementOpportunity Scholarship Tax Credit Election Form.

Please use the link below to download 2020-pennsylvania-form-rev-1123pdf and you can print it directly from your computer. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to expand educational opportunity. Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1123 IMPORTANT.

Of Educational Improvement Tax Credit EITC or Opportunity Scholarship Tax Credit OSTC awarded to a pass-through entity or special purpose entity along with the amounts of the EITC or OSTC to be passed through to the. A separate election must be submitted for each year an EITCOSTC is awarded. Return the election form to.

The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational. 70 of Philadelphia K-8th grade public schools are on Pennsylvanias list of lowest-performing schools and parents are desperate for better. Scholarship Tax Credit Election Form to report the amount.

Identification Number Revenue ID FEIN SSN. A pass-through EITCOSTC can be applied to all classesof income earned by the owners. Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV-1123 Pass-Through Entity Name.

FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING EX 12-20 REV-1123 BUREAU OF INDIVIDUAL TAXES PO BOX 280604 HARRISBURG PA 17128-0604 EDUCATIONAL IMPROVEMENT OPPORTUNITY SCHOLARSHIP. How Do PA Educational Tax Credits Work. Scholarship Tax Credit Election Form to report the amount.

Additionally the REV-1123 Educational Improvement Opportunity Scholarship Tax Credit Election Form will be revised to reflect the carryover provisions.

Educational Improvement Tax Credit Eitc Program Bucks County Community College

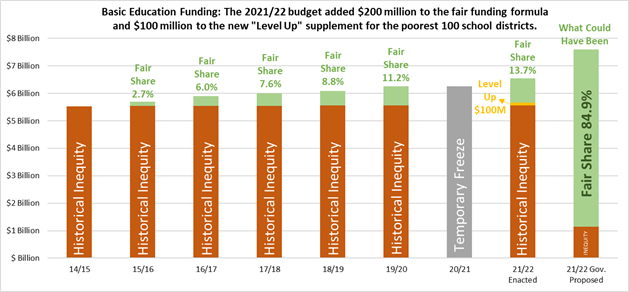

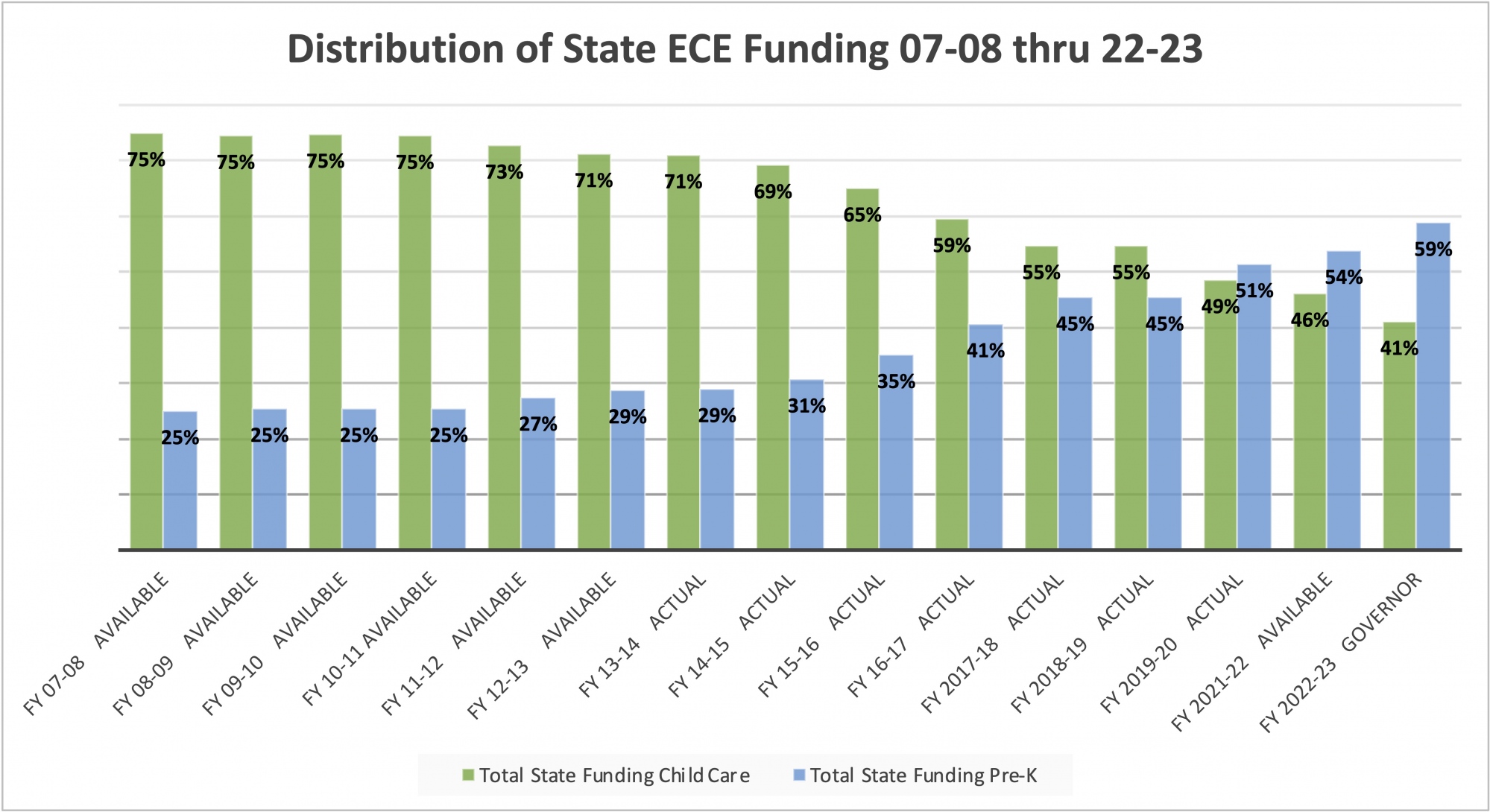

State Policy Budget Issues Pennsylvania Child Care Association

Tompkins Vist Bank Contributes To Youth Education Organizations Daily Local

School Resources Provident Charter School For Children With Dyslexia

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation

School Resources Provident Charter School For Children With Dyslexia

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

New York Education Laws Lexisnexis Store

Educational Improvement Tax Credit Eitc Program Bucks County Community College

The Earned Income Tax Credit For Childless Workers Largely Fails To Increase Employment Or Earnings Better Alternatives Needed The Heritage Foundation