life insurance policy types

Accidental Death and Dismemberment ADD Insurance Definition. With these considerations in mind take a look at the following article for general expectations out of a life insurance policy.

![]()

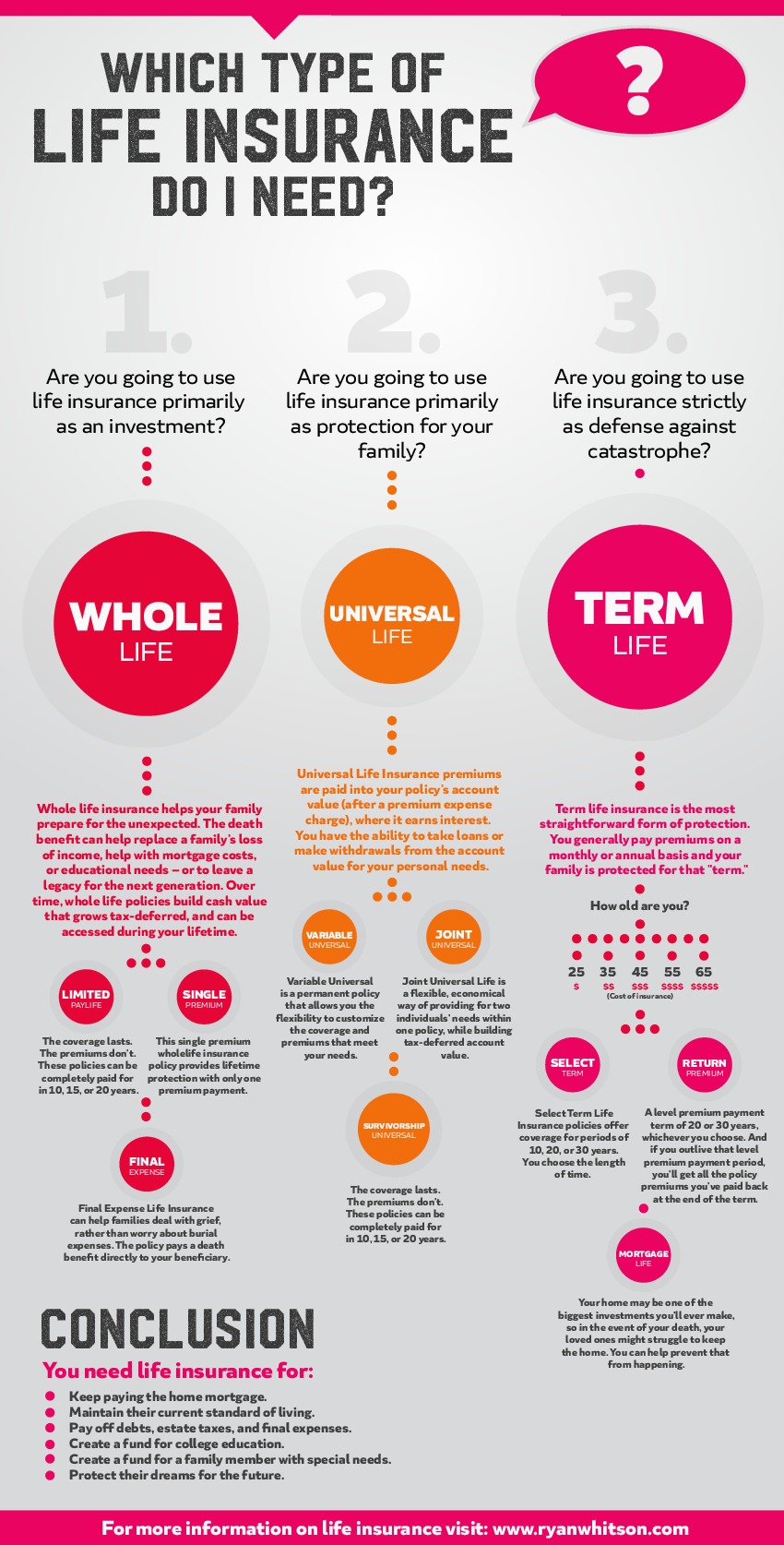

How To Pick The Right Life Insurance How Much You Need

It is the most basic and affordable type of policy and pays out a death benefit if the.

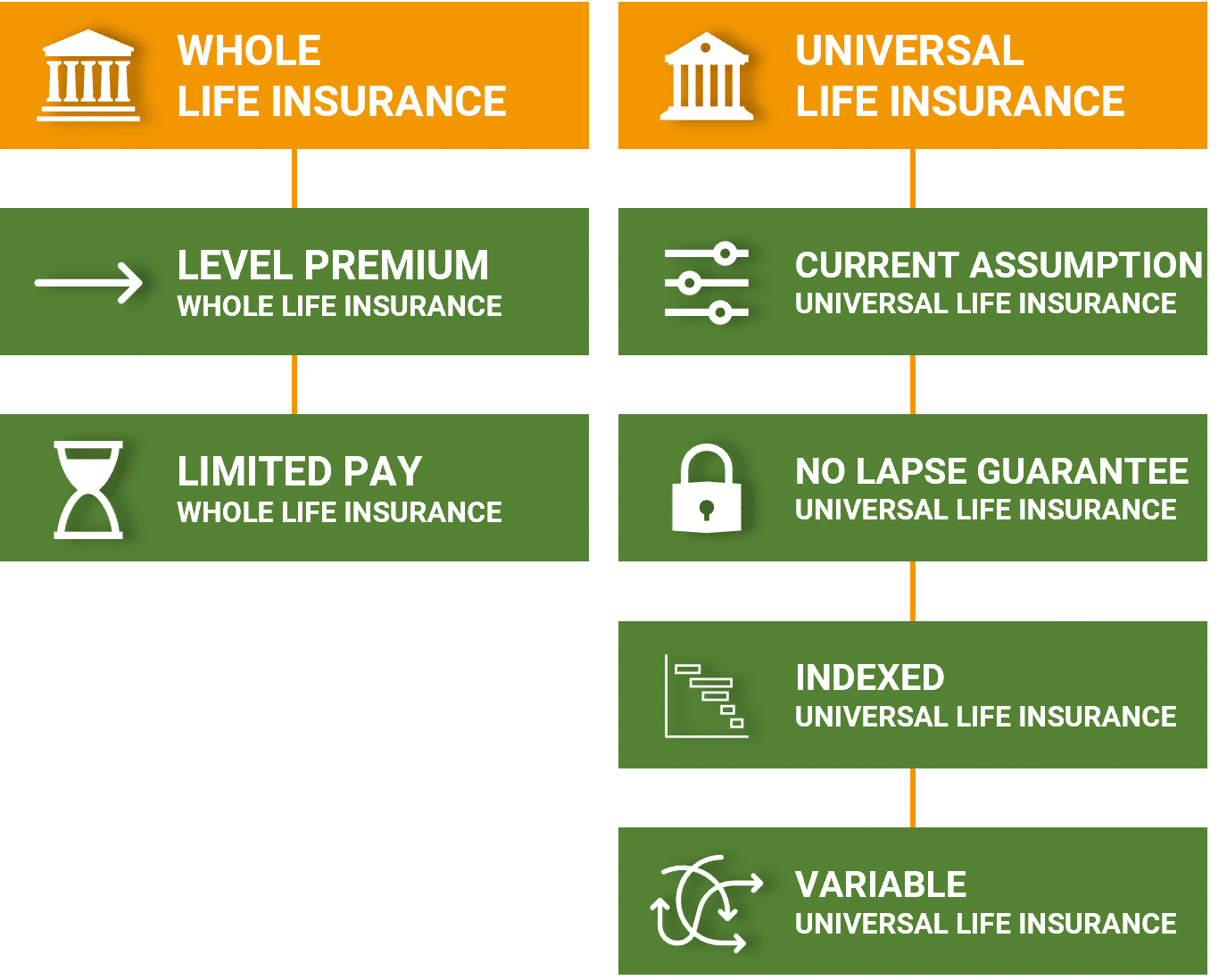

. B Modified premium ordinary life single premium. Here are some of the different types of whole life insurance. However whole life insurance policies have the cash-out option that policyholders can.

Offers life insurance coverage till 100 years of. Provides full risk cover against any type of eventuality. It and universal life insurance are the two most commonly sold types of life insurance policies on the market.

Variable life insurance. Types of Life Insurance Policies. C Single premium modified premium ordinary life.

It provides coverage for a specific period usually 10 20 or 30 years. 3 Types of Permanent Life Insurance. Different types of life insurance.

Common types of life insurance include. Types of Life Insurance. You must get a policy through an AAA agent and youll be asked to complete a medical questionnaire if.

Three types of permanent life insurance policies include. D Ordinary life modified premium single premium. 1 day agoLife insurance has a variety of policy types with term being one of the more popular ones.

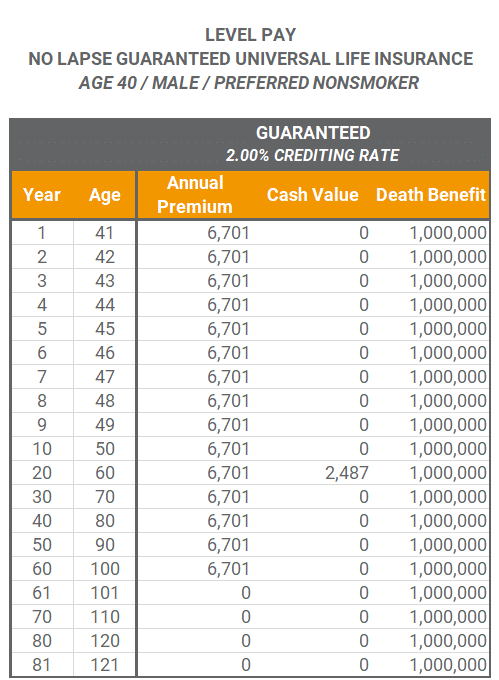

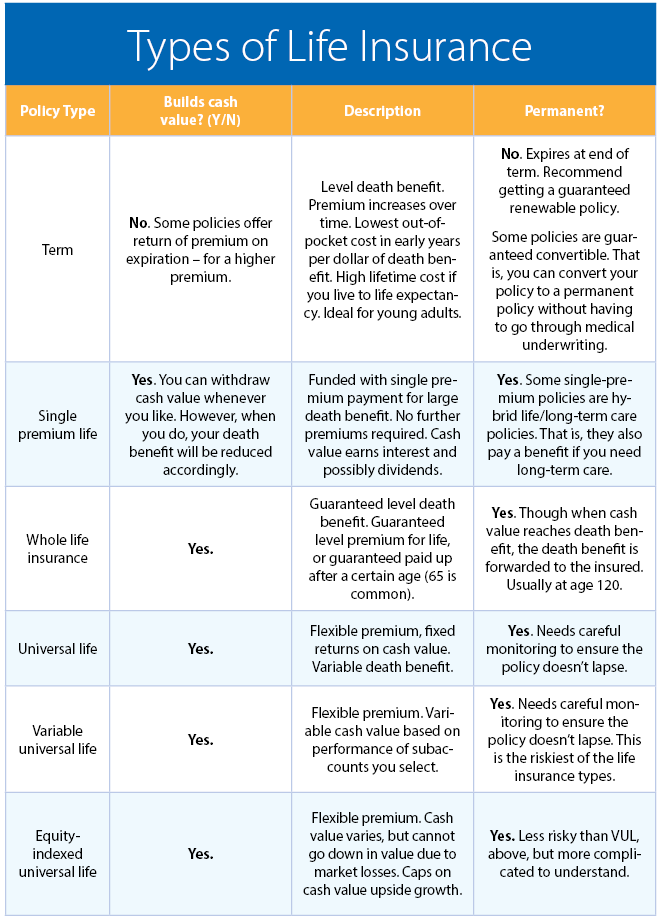

AAA Whole Life Insurance has coverage ranging from 5000 to 75000. Premiums and benefits are typically guaranteed and are established when you buy. Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely but also accumulate a cash value.

Limited pay life insurance is simply a type of policy that requires the individual to pay premiums over a specified period of time or up to a certain age. Different Types Of Life Insurance. Variable life insurance is a permanent life policy offering higher cash value growth potential from investments in a portfolio with up to 50 options such as bonds stocks and.

Life insurance plans provide funds that can be used to cover major expenses such as mortgages or college tuition as well as monthly bills and day-to-day living. The two main types of life insurance options are term life and permanent life. 6 rows The five main types of policies you may encounter when shopping for a life insurance.

Term Life Insurance. Updated May 26 2022. A life insurance policy provides financial protection for your loved ones and mitigates the loss of.

What is cash value life. This type of policy lets you invest your cash value in various. Updated May 23 2022.

A standard whole life policy requires premium payments.

Financial Advisor Hi Friend Type Of Life Insurance Policy Facebook

A Complete Guide To Life Insurance Expensivity

Types Of Life Insurance Md In The Black

Life Insurance For Business Owners Sproutt

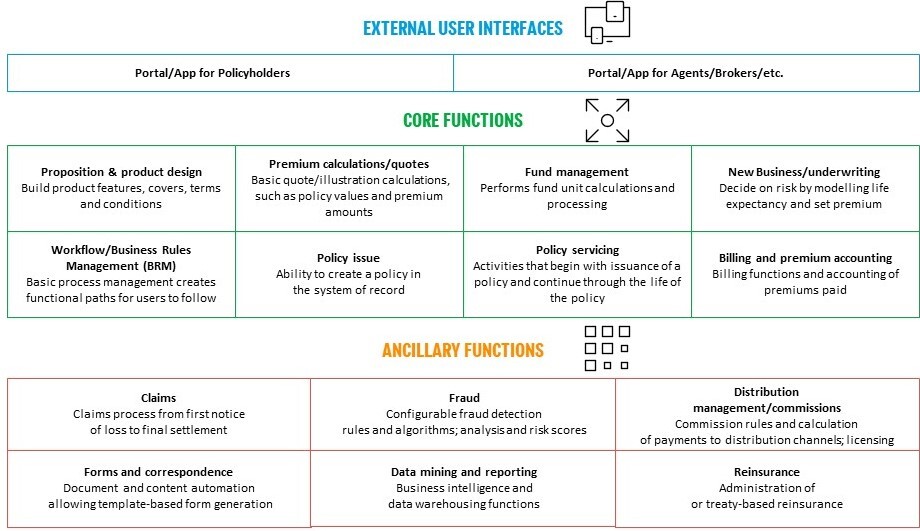

Life Insurance Policy Administration Systems Asia Pacific Edition 2021 Spectrum Report Powered By Vendormatch Celent

What Are The Principal Types Of Life Insurance Iii

5 Types Of Life Insurance Policygenius

Which Type Of Life Insurance Policy Is Right For Me Visual Ly

What Are The Different Types Of Life Insurance Part Ii Financial Planning And Stewardship

Kaminsky Associates There Are Many Types Of Life Insurance Policies That Can Help Protect Your Family And They All Fall Into Two Main Categories Term And Permanent Check Out Our

Types Of Life Insurance A Complete Guide

Why You Should Never Invest In A Life Insurance Policy Millionaire Before 50

Types Benefits Of Life Insurance Policy In Uae Abhishek Datta

A Guide To Life Insurance Policy And Its Benefits

What Are The Different Types Of Life Insurance Policies

Whole Life Insurance Provide Security For Your Family

Two Types Of Life Insurance Policies Term Permanent Coverage

Understanding Life Insurance What Policy Type Is Best For You